Freight rates continue to decline, is it temporary? Or a harbinger of weak demand?

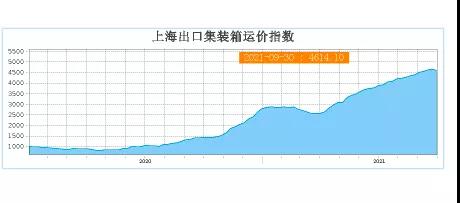

Spot freight rates on major routes are still on a downward trend. This week, Xeneta's XSI, Drewry's WCI and the Baltic Sea Freight Index (FBX) showed that rates on the Asia-Europe and trans-Pacific routes were either down or unchanged from last week. On the Asia-Europe route , the Drewry WCI index was at US$9,784/TEU, unchanged from last week; the FBX index was at US$10,643/TEU, down 1% compared with last week; Ningbo Containerized Freight Index (NCFI) reported It is said that due to the limited demand for freight, the loading rate of the European route has not performed well recently. Under pressure, some liner companies have voluntarily lowered the freight rate to strengthen the collection of goods, and the spot market booking price has fallen . The freight index of European routes was 4141.8 points, down 3.7% from last week. On the trans-Pacific route , the Asia-Western part of the United States, the Drewry WCI index showed a decline of 3% to $8,378/FEU; the FBX index showed...